- English

- Español

- Português

- русский

- Français

- 日本語

- Deutsch

- tiếng Việt

- Italiano

- Nederlands

- ภาษาไทย

- Polski

- 한국어

- Svenska

- magyar

- Malay

- বাংলা ভাষার

- Dansk

- Suomi

- हिन्दी

- Pilipino

- Türkçe

- Gaeilge

- العربية

- Indonesia

- Norsk

- تمل

- český

- ελληνικά

- український

- Javanese

- فارسی

- தமிழ்

- తెలుగు

- नेपाली

- Burmese

- български

- ລາວ

- Latine

- Қазақша

- Euskal

- Azərbaycan

- Slovenský jazyk

- Македонски

- Lietuvos

- Eesti Keel

- Română

- Slovenski

- मराठी

- Srpski језик

चीनी निर्मित धूल हटाने के उपकरणों को आयात करने के लिए संयुक्त राज्य अमेरिका को कितना टैरिफ भुगतान करने की आवश्यकता है?

2025-05-22

Recently, since the Sino-US Geneva economic and trade talks on May 14, 2025, the US tariff policy on China has entered a dynamic adjustment period of base tariff rate + phased exemption, with a 90-day buffer period (May 14, 2025-August 12).

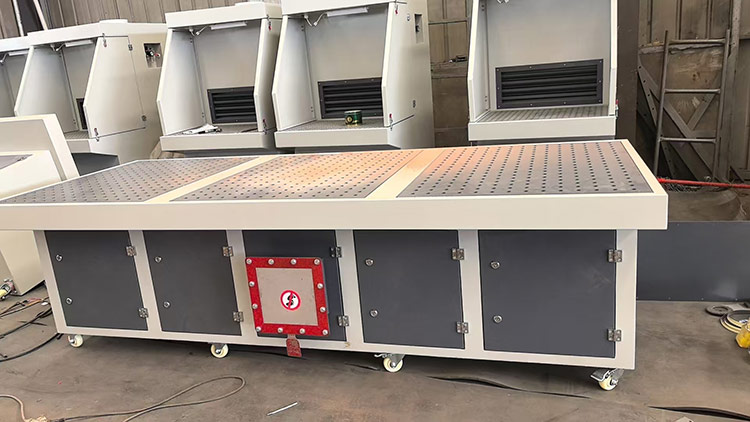

The sales volume of dust removal grinding tables exported to the United States by our factory has surged. Botou Xintian Environmental Protection Equipment Co., Ltd. is a manufacturer specializing in the research and development, production and sales of dust removal equipment.

The main products are Vacuum grinding table, flat vacuum sanding table, welding fume purifier, cloth bag dust collector, ect..

According to the latest Sino-US tariff policies and industry trends, the tariffs on dust removal equipment imported from China to the United States need to be calculated in combination with the following key information:

Current comprehensive tax rate

1. Base tax rate: All Chinese goods exported to the United States are subject to a basic tariff of 10%, covering most goods except strategic materials.

2. Reciprocal tariff adjustment:

- 90-day buffer period (May 14-August 12, 2025): suspend the 24% "reciprocal tariff" and retain only the 10% base rate.

- After the buffer period: If no new agreement is reached, the tariff rate may be restored to 34% (10% base + 24% reciprocal).

3. Additional tariff superposition: If dust removal equipment is involved in anti-dumping/countervailing (AD/CVD) investigations, additional tariffs may be imposed. For example, Chinese activated carbon was once subject to anti-dumping and anti-subsidy duties of 13.78%-228.11%.